Table of Contents

Silver isn’t just your grandmother’s favorite piece of jewelry—it’s a precious metal with a wide range of applications, from industrial uses to investments. While it’s got a soft touch, silver is incredibly valuable for its conductive, reflective, and antimicrobial properties. Yet, despite its abundant uses, the supply chain for this shiny metal is complex and tightly controlled. In this blog, we’ll uncover five powerful insights into the global silver mining supply and what the future holds for this glittering industry.

1. The Basics: Where Does the World’s Silver Come From?

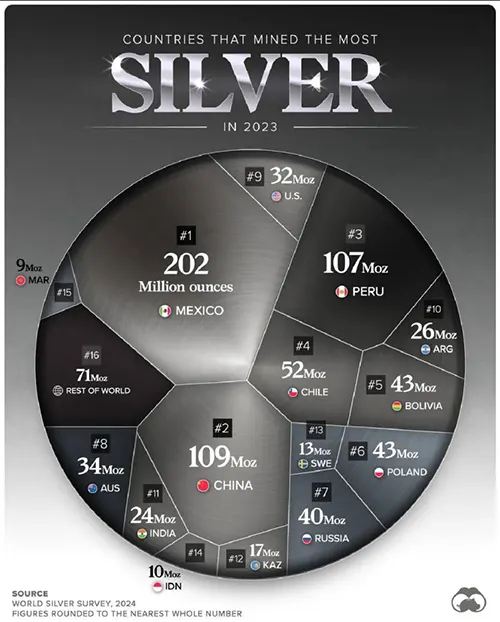

When you think of silver, you might envision ancient coins or modern-day jewelry, but did you know that most of the world’s silver comes from a handful of countries? According to the U.S. Geological Survey, the global silver mining supply is supported by reserves estimated at about 550,000 metric tons. These reserves are primarily located in South America, North America, Europe, and Asia, with Peru, Mexico, Poland, China, Russia, and Australia topping the list. The top eight silver-rich countries hold approximately 70% of the world’s total silver reserves, highlighting the concentrated nature of global silver mining supply.

The majority of silver supplied to the market comes from mining operations, accounting for about 80% of the total supply. The remaining 20% is derived from recycled silver. Interestingly, silver mining is often a byproduct of mining other metals such as copper, lead, and zinc. For example, in Peru and China, a significant portion of silver production comes from copper mines, while Mexico boasts numerous independent silver mines, leading to higher production efficiency in the global silver mining supply chain.

2. Top Producers: Who Leads the Silver Pack?

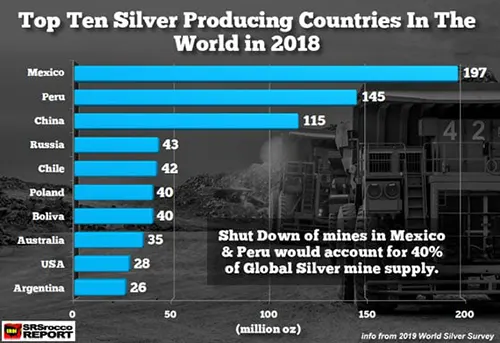

In 2022, the world’s leading silver producers were Mexico, China, and Peru. Mexico, known for its abundant independent silver mines, led the charge, followed by China and Peru. Despite being rich in silver reserves, Peru’s production was only about half of Mexico’s due to its focus on copper mining, which yields less silver as a byproduct, affecting the global silver mining supply.

In Mexico, the majority of silver comes from independent mines, which are more cost-effective and yield higher amounts of silver compared to mines where silver is a secondary product. Meanwhile, Peru’s production is more constrained due to the prevalence of copper-silver mines, which naturally limits the amount of silver extracted. These dynamics play a significant role in shaping the global silver mining supply landscape.

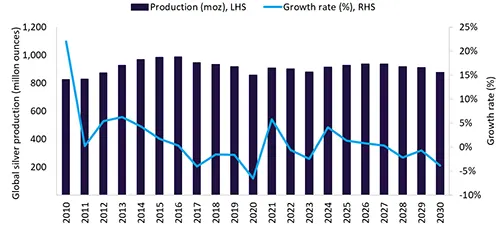

2020 threw a wrench into the mining gears as the global pandemic caused significant disruptions, leading to a 4.6% drop in the global silver mining supply to 24,329 metric tons. However, as the world started to recover in 2021 and 2022, mining operations gradually returned to normal, and production increased to around 25,000 metric tons annually. While this is still shy of the pre-pandemic levels of over 26,000 metric tons, the industry is on a steady path to recovery, with the global silver mining supply gradually rebounding.

3. A Closer Look: Key Silver Mines Around the World

Among the top silver mines, several stand out for their significant contributions to the global silver mining supply. The world’s largest silver mine is the KGHM Polska Miedź mine in Poland, with an impressive output of 1,316 metric tons in 2022, a 1% increase from the previous year. This mine is primarily a copper-silver mine, with silver reserves estimated at 68,000 metric tons, making it a world-class deposit crucial to the global silver mining supply.

Mexico’s Penasquito mine comes in second, producing 1,008 metric tons of silver in 2022. Located in the Zacatecas region, this mine is a behemoth, producing not just silver but also gold, lead, and zinc. However, its silver production saw a 5% decline compared to 2021 due to lower ore grades, impacting the global silver mining supply.

Russia’s Dukat mine, the third-largest silver mine globally, produced 569 metric tons in 2022. Operated by Polymetal, this mine is one of Russia’s most significant silver assets. Despite facing the challenge of depleting reserves, it remains a key player in the global silver mining supply.

India’s Sindesar Khurd mine ranks fourth in global silver production, with an output of 557 metric tons in 2022. This mine is primarily a lead-zinc mine with silver as a byproduct, managed by Hindustan Zinc Ltd, one of the world’s largest zinc producers. Its contribution to the global silver mining supply remains significant.

Peru’s Antamina mine rounds out the top five, producing 457 metric tons of silver in 2022. While this mine is primarily focused on copper production, it also produces a significant amount of silver. Unfortunately, production has been declining due to lower ore grades and operational challenges, further stressing the global silver mining supply.

4. Regional Dominance: South America and North America Lead the Way

South America and North America are powerhouses in the global silver mining supply, together accounting for nearly 60% of global production. South America, led by Peru and Mexico, has some of the richest silver deposits in the world. However, the region faces challenges such as political instability, regulatory changes, and social unrest, which can impact mining operations and the global silver mining supply.

North America, particularly the U.S. and Canada, also plays a crucial role in the global silver mining supply. While the U.S. is not a top producer, it has significant reserves and a strong mining infrastructure that supports both domestic production and international trade, contributing to the stability of the global silver mining supply.

5. The Future of Silver: What Lies Ahead?

Looking ahead, the global silver mining supply is expected to see modest growth in production. The Silver Institute projects that global silver mine production will reach 26,200 metric tons in 2023, a 2.4% increase from 2022. However, this still falls short of the average production levels over the past decade, which have hovered around 26,500 metric tons.

One of the main challenges facing the silver mining industry is the declining ore grades in existing mines. As high-grade deposits become scarcer, miners must turn to lower-grade ores, which are more expensive to process and yield less silver. This trend is expected to continue, putting upward pressure on silver prices and adding strain to the global silver mining supply.

On the bright side, new silver mining projects are on the horizon in countries like Mexico and Poland. These projects could help offset declining production from older mines and contribute to a more stable global silver mining supply.

Another factor influencing the future of silver is the growing demand for green technologies. Silver is a critical component in solar panels, electric vehicles, and other renewable energy technologies. As the world shifts towards a more sustainable future, the demand for silver is expected to rise, potentially leading to higher prices and increased investment in mining projects, which could positively impact the global silver mining supply.

Conclusion: The Silver Lining in a Complex Supply Chain

The global silver mining supply is a dynamic and complex industry, influenced by a variety of factors including ore grades, mining technology, and market demand. While the industry faces challenges such as declining ore grades and geopolitical risks, there are also opportunities for growth, particularly in regions like South America and North America.

As the world’s appetite for silver continues to grow, driven by its industrial applications and investment appeal, the mining industry must adapt to meet this demand. Whether it’s through new mining projects or more efficient extraction methods, the future of silver looks bright—shiny, even.