Table of Contents

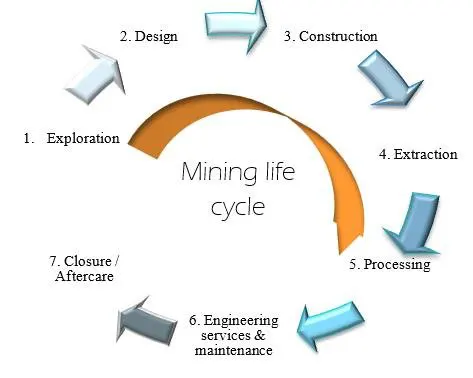

What is the U.S. mining development timeline? When it comes to developing new mines, the United States is in the slow lane. According to a recent report by S&P Global, the time it takes from discovering a mineral deposit to bringing a mine into production in the U.S. is a staggering 29 years. This extended timeline places the U.S. second only to Zambia, where it takes 34 years to accomplish the same feat. But why does it take so long, and what does this mean for the future of mining in the U.S.?

Let’s dive into seven surprising facts about the U.S. mining development timeline and its broader implications for the industry.

1. Why Is the U.S. So Slow at Developing Mines?

You might think that with the U.S.’s vast mineral wealth, new mines would pop up like daisies. But that’s far from reality. The U.S. mining development timeline is notoriously lengthy, taking an average of 29 years. This delay contrasts sharply with other countries like Canada and Australia, where the timeline is significantly shorter.

One of the primary reasons for this sluggish pace is the extensive regulatory process in the U.S. New mining projects often face opposition from environmental groups and indigenous communities, leading to lengthy legal battles and delays. Additionally, the permitting process is incredibly complex, involving multiple federal and state agencies. These layers of bureaucracy contribute to the prolonged timeline.

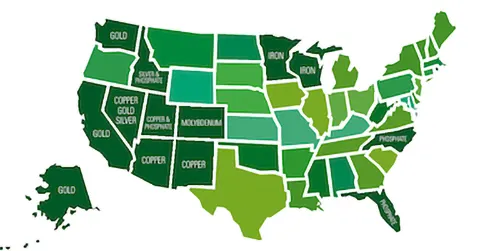

2. U.S. Mineral Resources: Plenty in the Ground, But Hard to Get Out

Despite the delays, the U.S. is sitting on a treasure trove of mineral resources. The report highlights that the U.S. has copper reserves estimated at 275 million tons, comparable to those of Canada and Australia. With these resources, the country could easily meet its domestic demand for copper in the foreseeable future.

But it’s not just copper that the U.S. has in abundance. The country also boasts over 43 million tons of lithium resources, more than double that of Australia, which currently produces half of the world’s lithium. However, these resources are largely untapped due to the long U.S. mining development timeline.

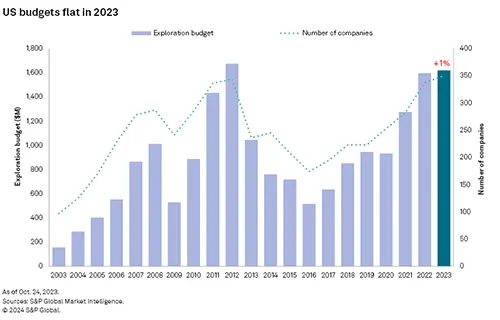

3. Exploration Budgets: The U.S. Lags Behind

You’d think that with such rich resources, the U.S. would be pouring money into mineral exploration. However, the report reveals that the U.S. exploration budget is relatively low compared to other developed economies. Over the past 15 years, exploration investment in Australia and Canada has grown by 57% and 81%, respectively. In contrast, the U.S. has not kept pace, which further hampers its ability to develop new mining projects quickly.

4. Case Study: Delays in U.S. Mining Projects

The S&P Global report examined the development timelines of 268 mines worldwide, most of which are now operational. Since 2002, only three mines in the U.S. have reached production. Meanwhile, 10 other projects have been in development for decades without producing a single ounce of metal. One of these projects has been under development since 1978!

Among the most significant delayed projects is the Resolution Copper Mine in Arizona, a joint venture between Rio Tinto and BHP. Despite its potential to supply a quarter of the U.S.’s copper demand, the project faces significant opposition from indigenous groups and environmentalists, further extending its timeline.

Another example is the Pebble Copper-Gold Project in Alaska, developed by Northern Dynasty. Like the Resolution project, it faces strong opposition, contributing to its long U.S. mining development timeline.

5. The Financial Impact: Over $100 Billion in Idle Resources

The lengthy development timelines have significant financial implications. The S&P Global report notes that the combined value of the 10 major U.S. mining projects still under development—covering copper, gold, lithium, and zinc—exceeds $100 billion. These resources remain untapped, representing missed economic opportunities for the U.S. mining sector and the broader economy.

6. Global Comparison: How Does the U.S. Stack Up?

When compared to other countries, the U.S. mining development timeline is significantly longer. Countries like Ghana, the Democratic Republic of Congo, and Laos have much shorter development timelines, averaging just 10 to 15 years. Even in Australia, where the regulatory environment is stringent, the average timeline is 20 years, still nine years shorter than in the U.S.

This extended timeline in the U.S. has led to a decline in mineral exploration investments. With investors seeing quicker returns in other countries, the U.S. mining sector risks losing out on crucial capital, which is essential for discovering and developing new mines.

7. The Future of U.S. Mining: Can We Speed Things Up?

The slow U.S. mining development timeline has already deterred investment and delayed the production of critical minerals. As the demand for these minerals increases—especially for those like lithium, which is essential for battery production—the U.S. will need to find ways to accelerate its mining development processes.

One potential solution is streamlining the permitting process to reduce the layers of bureaucracy that delay project approvals. Another is fostering better relationships between mining companies, indigenous communities, and environmental groups to address concerns more collaboratively. Lastly, increasing exploration budgets could help the U.S. discover and develop new mineral resources more quickly, reducing its reliance on imports and strengthening its position in the global market.

Conclusion: What’s Next for the U.S. Mining Sector?

The U.S. mining development timeline presents significant challenges to the country’s ability to harness its vast mineral resources. While the U.S. has some of the world’s richest deposits of copper, lithium, and other essential minerals, the time it takes to bring these resources to market is far too long. As global demand for these minerals grows, the U.S. must find ways to streamline its mining development processes, reduce delays, and encourage investment.

Ultimately, the future of the U.S. mining sector depends on its ability to adapt and overcome these challenges. If successful, the U.S. could become a global leader in mineral production, ensuring a steady supply of critical resources for decades to come.